Insight and partnership

We seek private equity returns by providing capital and expertise with a focus on investing for the long-term and through economic cycles. Our aim is to be the investment partner of choice for private equity funds, other long-term investment institutions, founders and management teams.

With a focus on agility and transparency, we can execute large, complex global transactions across the capital structure in varying investment sizes.

We look for investment partners with a strong track record, a demonstrated value creation strategy, strong value orientation and best-in-class governance standards. We invest in companies that demonstrate a strong market position, an attractive cash flow profile, resilience through economic cycles and a top-tier management team.

Fast facts

-

Target investment size from $100M to $250M

-

Investing both through funds and directly

-

Over 40 investment professionals in Montréal, London, Hong Kong and New York

What sets us apart?

-

Global scale

-

Long-term investment horizon

-

Agile decision-making and transparency

Private Equity at a glance

[In C$ as at March 31, 2025]

Net assets under management (AUM)

Portfolio income

1-year rate of return

5-year annualized return

Discover where we invest

Geographic diversification

-

65.5%US

-

18.2%Europe

-

12.9%Asia

-

1.9%Canada

-

0.9%Oceania

-

0.6%Other

Sector diversification

-

23.2%Financials

-

16.6%Technology

-

16.5%Health care

-

14.3%Industrials

-

11.1%Communications

-

9.6%Consumer discretionary

-

2.6%Materials

-

1.9%Consumer staples

-

1.5%Energy

-

2.7%Other

Private Equity in action

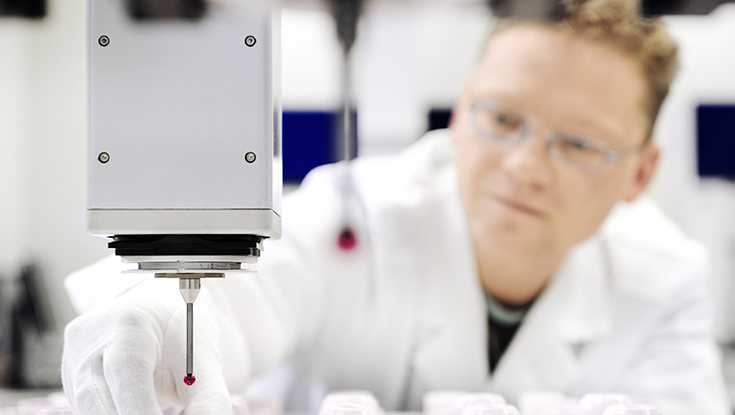

Collaborating on innovative initiatives

Company: Galderma (formerly Nestlé Skin Health)

Headquarters: Switzerland

Sector: Healthcare

Date: 2019

Founded in 1981, Galderma is a leading global dermatology company offering a comprehensive portfolio of medical and consumer skin health products, and operating under three business units: aesthetics, prescription and consumer. As the world’s largest independent dermatology company, Galderma’s international team of 5,000 employees is committed to partnering with health care practitioners to deliver innovative technologies and products that meet the skin health needs of people throughout their lifetime. This investment is at the core of our investment strategy of backing a market leader with exceptionally strong brands and a clear strategic vision. We acquired a minority stake alongside a trusted partner.

Shaping the Future of Accounting Services

Company: PKF O’Connor Davies

Headquarters: United States

Sector: Professional Services

Date: 2024

In 2024, PSP Investments partnered with its long-standing investment partner Investcorp to acquire a significant interest in PKF O’Connor Davies, one of the 25 largest providers of accounting and advisory services in the United States. This strategic investment marked a defining inflection point for PKF O’Connor Davies, facilitating its evolution from a traditional professional partnership to a dynamic ownership model without compromising its distinct entrepreneurial culture. Since the investment, we have partnered closely with the PKF O’Connor Davies management team to build on its strong foundation and accelerate its long-term strategy. Together, we remain focused on enhancing overall client experience and driving profitable growth.

Meet our team leader

Explore other asset classes

Want to discover how you can experience the edge? Join our team.