The future is promising

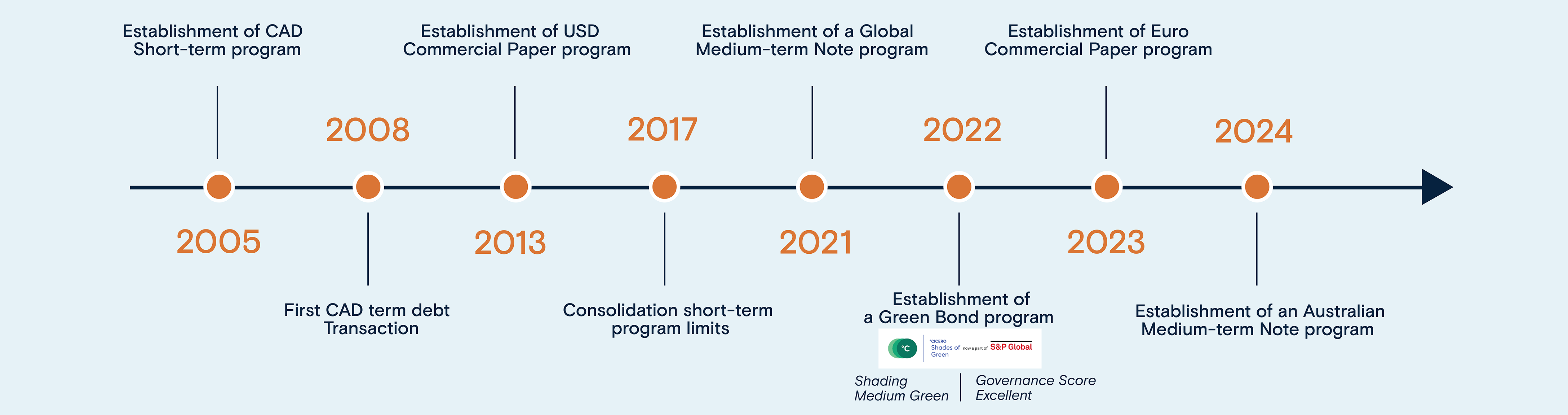

We anticipate that assets under management will double by 2040—and we expect the amount of debt we issue to follow the same trend. This will allow us to provide even greater value to a wider breadth of investors with a diversity of needs.