Detailed reports of our achievements & performance

Looking beyond the numbers

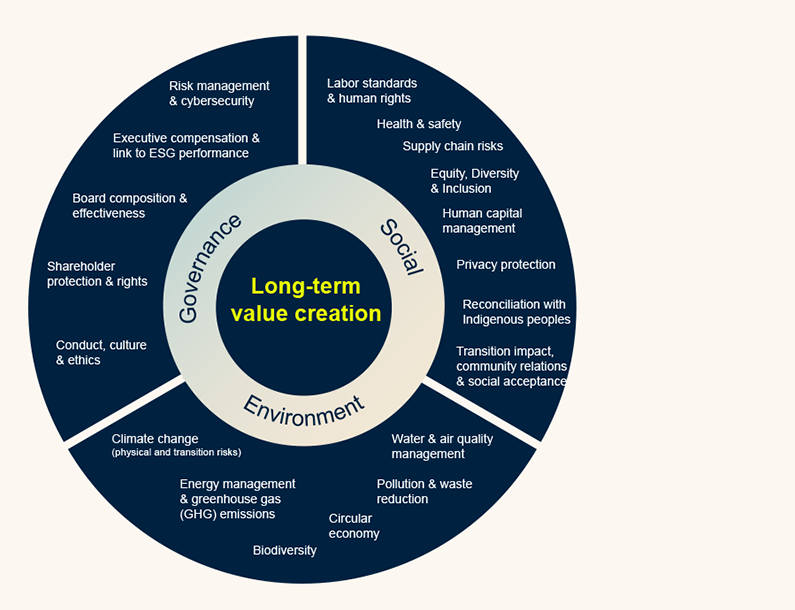

Environment

Assessing risks and opportunities such as climate change, water usage and waste

Social

Prioritizing worker, community and societal health and well-being

Governance

Encouraging high performing boards of directors and good governance practices

Contributing to the transition to global net-zero emissions by 2050

A roadmap to guide our climate action

PSP Investments believes that climate change is one of the most critical social, economic and environmental challenges of our time.

We acknowledge that climate change will have significant physical and economic impacts on the economy, communities and the environment. We are committed to using our capital and influence to drive Paris-aligned decarbonization outcomes across our investment portfolio.

We are also committed to supporting the transition to global net-zero greenhouse gas (GHG) emissions by 2050. By executing on our climate strategy, we anticipate reducing our portfolio GHG emissions intensity by 20-25% by 2026*, relative to our September 2021 baseline.

*Emissions trajectory is calculated on a weighted average carbon intensity basis, tonnes of CO2e per $M revenue.

Taking action on climate change

Using our capital and influence to accelerate the transition to global net-zero emissions.

As an institutional investor, we adopt a long-term world view and are seized with the potential for the financial sector to support the transition to global net-zero emissions. PSP Investments' actions are guided by our innovative bespoke Green Asset Taxonomy and our Climate Strategy Roadmap that outlines five focus areas:

Climate Integration

- Integrate climate risks and opportunities in investment decision-making & asset management practices

- Conduct climate scenario analysis and stress-testing

Climate Investing & Sustainable Finance

- Increase investments in green and transition assets

-

Reduce proportion of carbon-intensive investments without transition plans

-

Expand sustainability-linked financing

Engagement & Proxy Voting

- Further develop and continue to implement proxy voting principles and guidelines

- Engage with portfolio companies to develop mature transition plans

Reporting & Disclosure

- Advocate for TCFD-aligned disclosures

- Further develop & continue to operationalize our Green Asset Taxonomy

- Increase portfolio-wide GHG data coverage

Leadership & Collaboration

- Participate in investor-led initiatives on climate change-related matters

Our Green Asset Taxonomy

We recently developed and operationalized an innovative bespoke Green Asset Taxonomy which we used to quantify our GHG emissions exposure across our portfolio.* The Taxonomy allows us to track GHG changes at the asset level over time, monitor progress against our targets and inform our investment decision-making and approach to engagement.

A bespoke classification system that considers GHG performance to assess PSP Investments' baseline exposure across three types of climate-relevant investments:

Green Assets

Investments in low-carbon activities that are contributing to climate mitigation and adaptation

Transition Assets

Investments that are committed to contributing to the low-carbon transition through targets and plans

Carbon Intensive

Investments in high-carbon sectors that lack transition plans or fail to show low-emission performance

*In scope: Long-Only Public Equities (Active and Passive); Real Assets (Direct and Indirect); Private Equity (Direct and Indirect). Out of scope: ETFs, Complementary Portfolio, Credit Investment, Fixed Income, Funds of Funds.

Short-term targets to guide progress

Climate Investing and Sustainable Financing

We pride ourselves on our long history of integrating ESG into investment decision-making. We are working with portfolio companies to support initiatives that aim to enhance the quality of our investment and engagement practices.

*Applied to in-scope AUM

Investing for a better tomorrow

Our Climate Strategy Roadmap is a call to action to our investment teams and business groups, portfolio companies, partners and stakeholders to work together in achieving our commitments and target.

Translating our beliefs into action

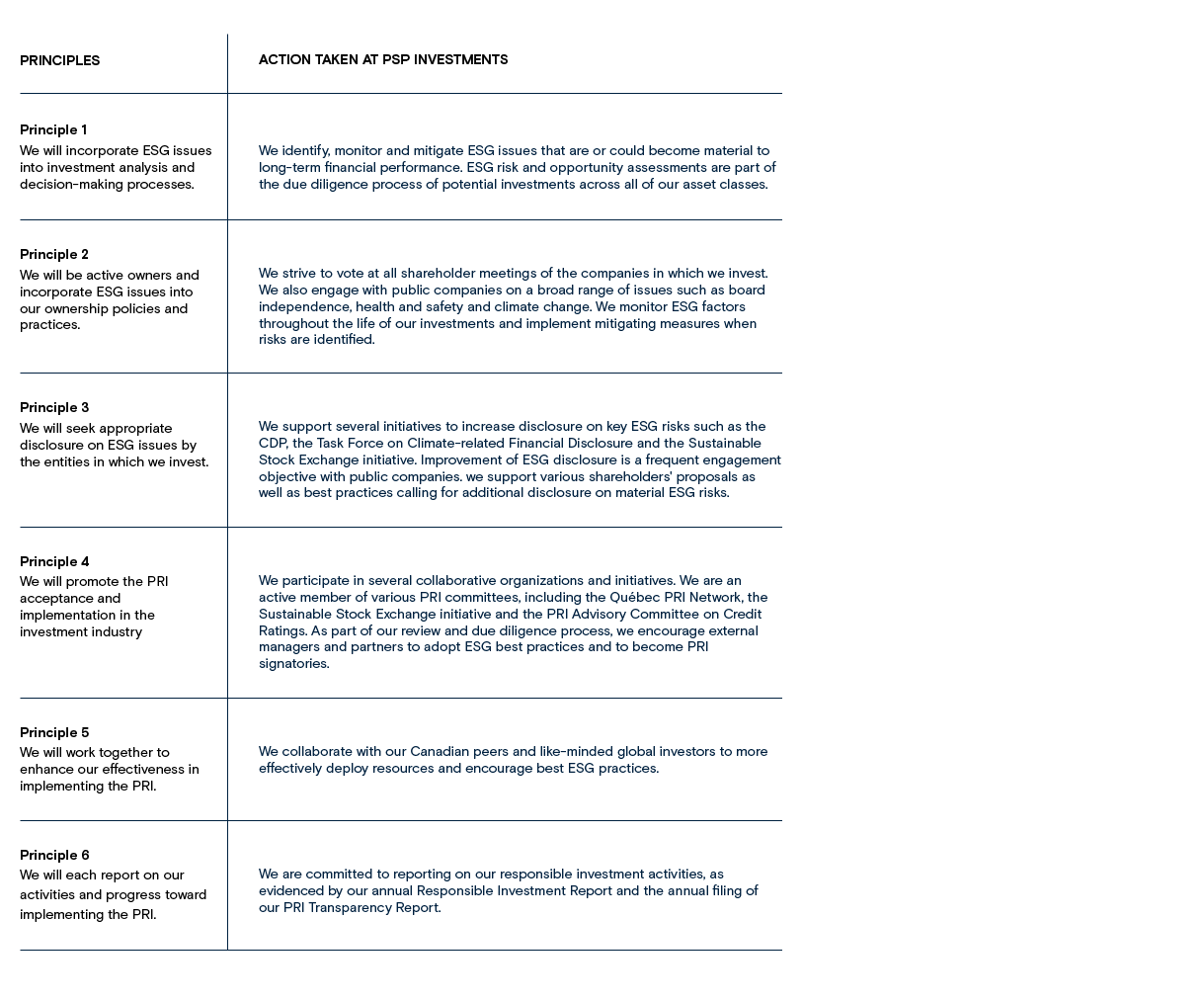

We believe that well-run companies that effectively manage social and environmental issues are more likely to prosper over time. That is why, as a long-term investor, we integrate environmental, social and governance (ESG) considerations into our investment analysis and decision-making, and support sustainable business practices among the companies we invest in.

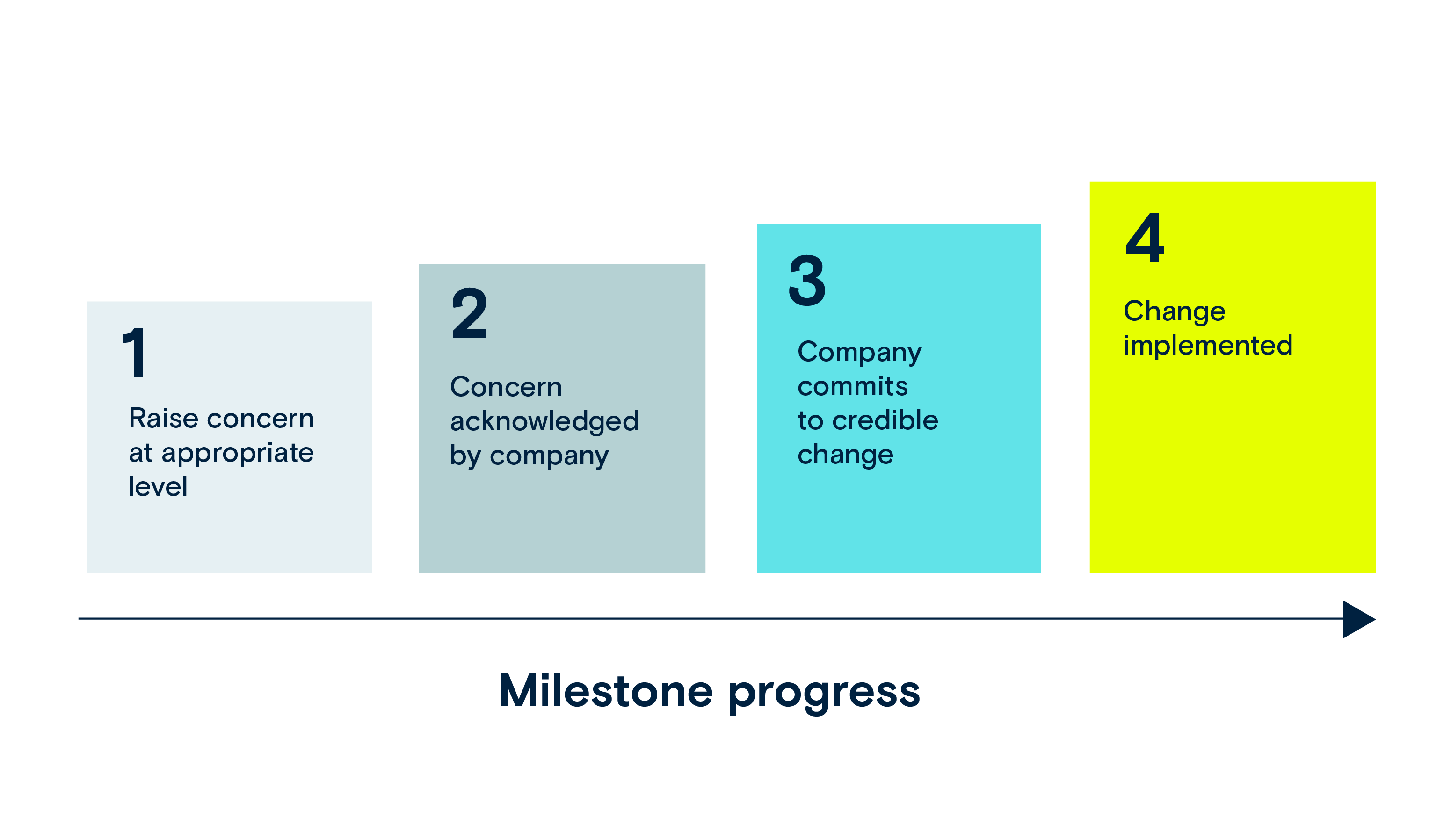

One of our roles as an investor is being an active steward of the assets we own, recognizing that stewardship is a shared responsibility. For PSP, sustainable investing means being committed to principles and collaborating with others to support robust and vibrant financial markets.

PSP is a member of the Canadian Coalition for Good Governance (CCGG) and supports the CCGG Stewardship Principles. The Principles offer a framework of key stewardship responsibilities and were designed to help articulate investors’ fiduciary role. Although the Principles were designed with a view towards application in Canada, they are consistent with international developments in stewardship guidance to complement, rather than supersede or conflict with, the stewardship principles or codes of other countries and organizations.

External research reports

How public pension and sovereign wealth funds mainstream sustainability

United Nations Conference on Trade and Development

Date: September 18, 2020

Climate Change Mitigation and Your Portfolio: Practical tools for investors

Investor Leadership Network

Date: September 15, 2020

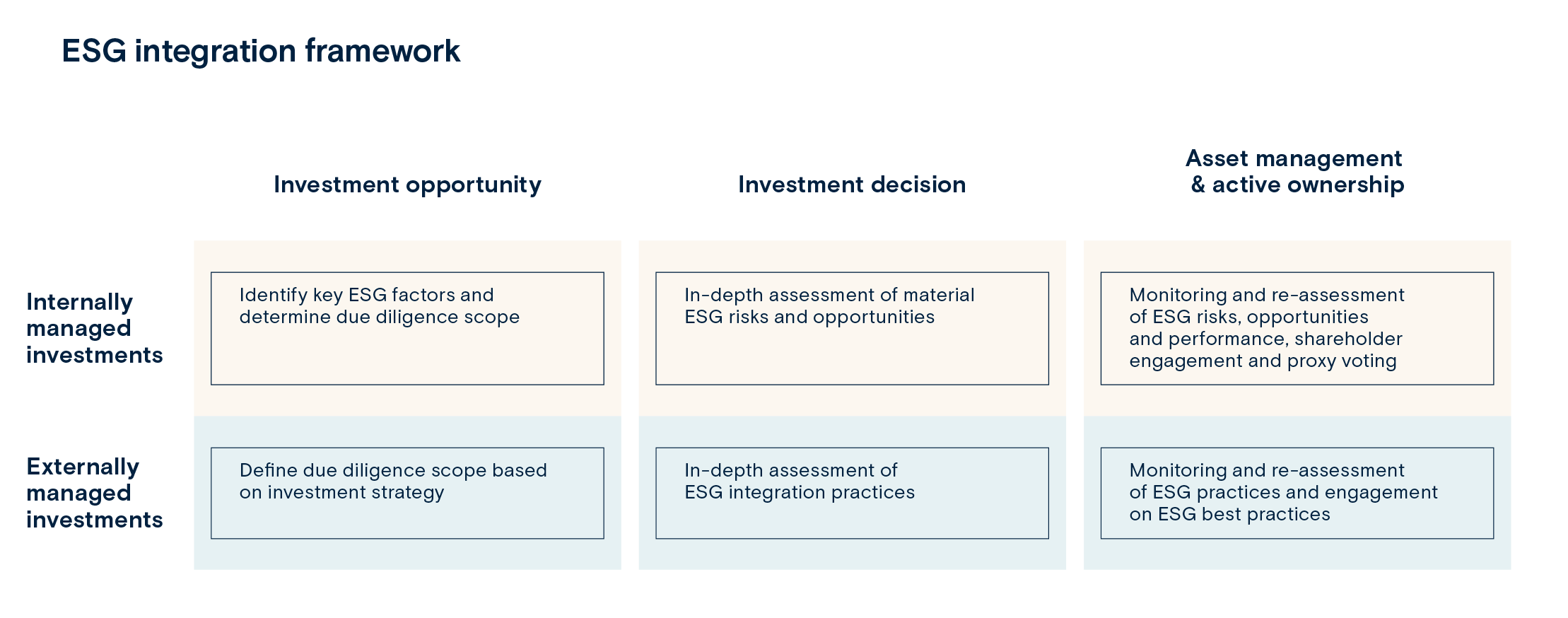

Integrating ESG in private investments

We conduct an in-depth ESG risk and opportunity analysis during the due diligence process for our private investments in Real Estate, Infrastructure, Natural Resources, Private Equity and Credit Investments. As owners, we closely monitor assets and engage directly with boards and management of our investee companies on material ESG risks and opportunities, with a view to protecting and enhancing long-term financial value.

Integrating ESG in public investments

As part of our investment analysis and decision-making processes, we identify material ESG factors that may impact the long-term financial performance of our public market investments. We leverage our ownership positions to promote good governance practices, exercising our proxy voting rights and actively engaging with companies. We take a stand on issues that matter to capital markets more broadly by supporting best practices. A report of each year’s engagement activities is provided in our annual Responsible Investment Report.

Integrating ESG in our Green Bond Framework

Through the issuance of Green Bonds, PSP Investments aims to fund projects that demonstrate positive environmental and climate outcomes for the benefit of society. Net proceeds from this issuance will be allocated to assets that demonstrate strong ESG performance and support the transition to a more environmentally sustainable economy. We established five high-level pillars to guide the development of our Green Bond approach. They describe the real-world outcomes we seek to achieve through our Green Bond program.